Business Insurance in and around Greensboro

Greensboro! Look no further for small business insurance.

No funny business here

Your Search For Reliable Small Business Insurance Ends Now.

Running a small business is hard work. Insuring your venture should be the least of your worries. State Farm insures small businesses that fall under the umbrella of retailers, trades, contractors and more!

Greensboro! Look no further for small business insurance.

No funny business here

Cover Your Business Assets

When one is as committed to their small business as you are, it is understandable to want to make sure all bases are covered. That's why State Farm has coverage options for worker’s compensation, commercial liability umbrella policies, surety and fidelity bonds, and more.

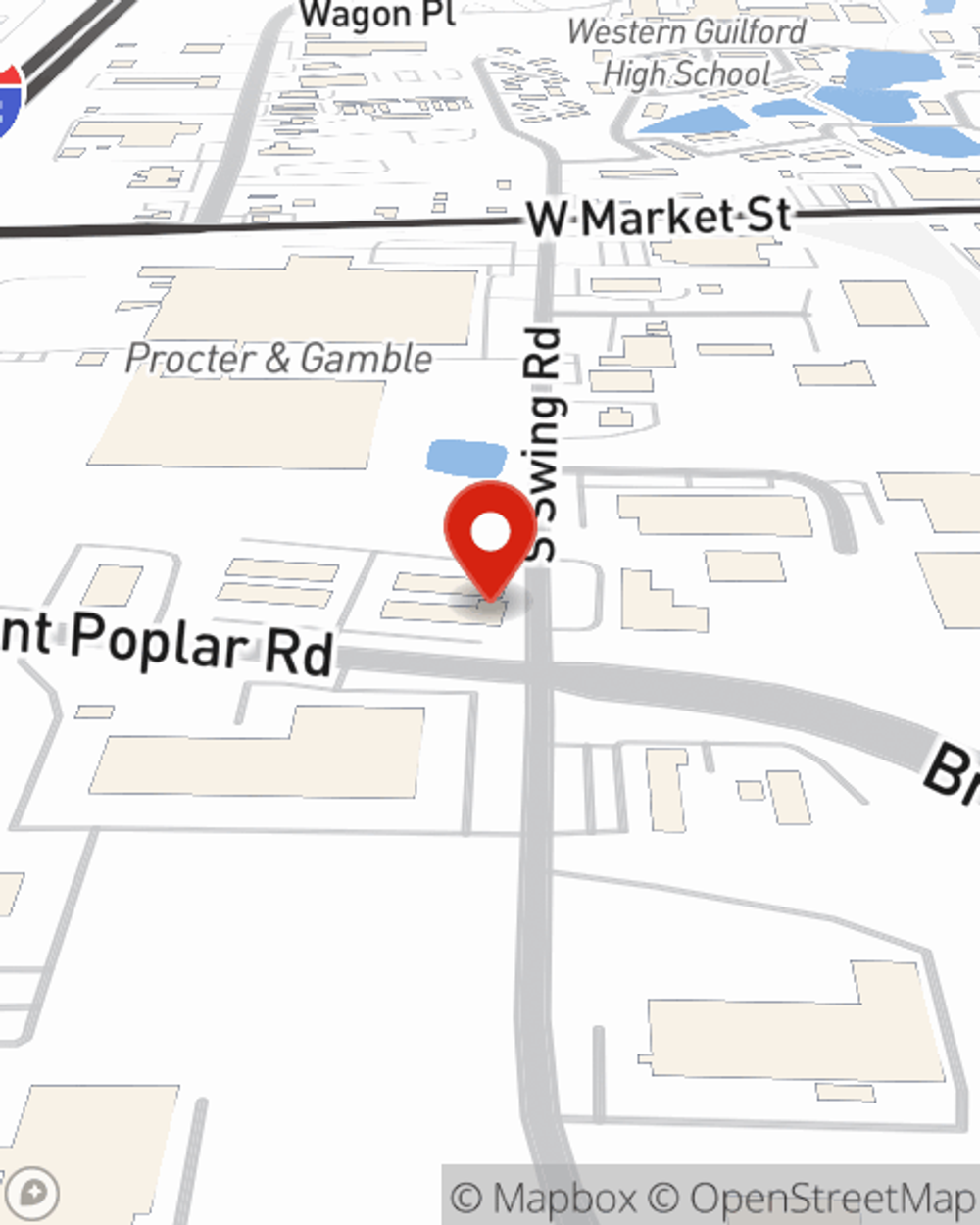

As a small business owner as well, agent Johnny Spillman, Jr. understands that there is a lot on your plate. Visit Johnny Spillman, Jr. today to chat about your options.

Simple Insights®

Key employee coverage issues

Key employee coverage issues

The death/disability of a key person can have a dramatic impact in a smaller business. Consider these questions to help determine discount factor percentage.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.

Johnny Spillman, Jr.

State Farm® Insurance AgentSimple Insights®

Key employee coverage issues

Key employee coverage issues

The death/disability of a key person can have a dramatic impact in a smaller business. Consider these questions to help determine discount factor percentage.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.